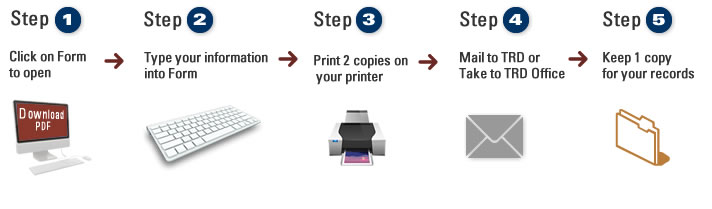

Fill, Print & Go

When you use our Print, Fill and Go Forms, you can walk into any of our District Offices with a completed tax form in your hands. The feature saves you the time you would otherwise spend looking for the form, printing it, filling it out in ink, and risking some difficulty on the part of the TRD employee if any of the ink isn’t clear enough to be read easily. You can use your computer keyboard to type your information directly onto the form you’ve chosen and speed up your time at the district office counter. Just follow the step-by-step instructions above.

Frequently Asked Questions

How should I enter information into the form?

Using your computer keyboard type the information directly onto the screen.

Should I include dashes, dollar signs, commas or texts with the data entered?

You can include dashes, dollar signs and commas in your entries.

Can I make changes after all the information has been entered on the form?

Yes, you can still go in and make changes after entering the information.

What do I do if I’ve entered the wrong information?

If you make an error, simply go back, delete the incorrect information and replace it with the correct information.

Should I save a copy of my completed form before sending or taking it to you?

You cannot save a copy of the completed form on your computer, but you can print it for your records.

What do I do with the completed form at the TRD Office?

When you get to the window or counter with your form, please let the employee know that you have already completed a Fill, Print and Go Form. He or she will give you further instructions if any are needed.

Forms

RPD-41209 | Gaming Operator Tax Return | Download PDF

RPD-41308 (A) | Fuel Retailer Schedule of Gasoline Purchases | Download PDF

RPD-41308 (B) | Fuel Retailer Schedule of Gasoline Purchases | Download PDF

CRS-1 | CRS-1 Combined Report (Short Form) For 3 or Fewer Business | Download PDF

PTD-0066 | 2011 65 and Older or Disabled | Download PDF

ACD-31110 | Financial Information Statement (Personal) | Download PDF

ACD-31111 | Financial Information Statement (Business) | Download PDF

ACD-31102 | Tax Information Authorization – Tax Disclosure | Download PDF

ACD-31015 | Business Tax Registration Application and Update Form | Download PDF