For more information and/or to request accommodations, contact the New Mexico Taxation and Revenue Department at trd.acdadmins@tax.nm.gov or call 505-372-8329

WHAT IS A

RAPID HIRE EVENT?

Tax and Rev is excited to quickly fill a variety of positions

within their agency.

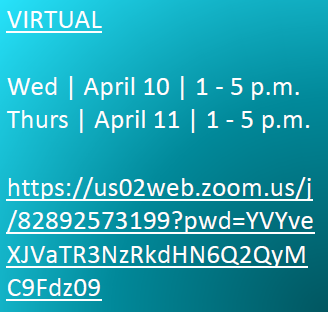

During the Rapid Hire Event, qualified applicants will be interviewed by the hiring state agency via Zoom and in most cases find out about a job offer same day or shortly after.

- A copy of your updated resume

- Three supervisor references

- Proof of right to work in the U.S.

- Must provide a copy of unofficial transcripts for any post-secondary level education received.

- Dress for success!The hiring packet that will be required at the event can be downloaded in advance at: https://www.tax.newmexico.gov/wp-content/uploads/2023/10/G-H-I-Interview-Packet.pdf

The completed packet can be emailed to: trd.acdadmins@tax.nm.gov or call 505-372-8329

The Audit and Compliance Division (ACD) enforces compliance with New Mexico tax laws. ACD employs a variety of tax research tools to analyze tax data to improve efficiency, streamline processes, improve customer service, and to develop new compliance programs and tax collection initiatives. The most crucial aspect of these position is prioritizing customer service in the public facing functions, performing audits, and performing tax collection functions.

- These positions are covered by a collective bargaining agreement and all term/conditions of that agreement apply and must be adhered to.

- All positions require applicant to possess a valid driver’s license and be current with all New Mexico reporting and payment of taxes.

- Most positions require occasional in-state travel, audit positions may involve out of state travel.

- All applicants must have a copy of resume and transcripts prior to interview, see minimum qualifications listed below: